|Reaching “Operational Excellence” in Business, Career and Life|

A while ago, I came across an interesting business interview question:

“Imagine a company with $10 million in revenue and 50% margin. You have two projects presented in front of you:

If you pursue Project A, you can increase revenue by 50% and maintain the same margin.

If you pursue Project B, revenue will stay the same, but you can boost the margin to 75%.

Assuming you will be successful and the bottom line will be the same in either option, which one would you pursue and why?”

Either can be the correct answer, depending on your rationale. But the point of this question is to test your understanding of the subtle difference between the two options.

I find understanding the implications of this difference particularly profound because it serves as useful operational guidance in bringing success to your organization, your team, and your career.

Being effective does not equate to being efficient!

People often mix up effectiveness and efficiency – while both terms have a positive connotation, their meanings differ.

Wikipedia has pointed out the distinction, where “efficiency is a measurable concept, quantitatively determined by the ratio of useful output to total useful input. Effectiveness is the simpler concept of being able to achieve a desired result, which can be expressed quantitatively but does not usually require more complicated mathematics than addition.”

The notion of “effectiveness” is more outcome oriented. One’s effectiveness is measured largely based on how much gross “impact” or “result” one has contributed towards a specific goal. The amount of time and effort one has put in is not emphasized.

On the other hand, the idea of “efficiency” is heavily input dependent. One’s efficiency is measured by how much impact one has contributed to a specific objective relative to the amount of resources spent.

Some may argue that effectiveness insinuates efficiency, but that is technically untrue.

My First Lesson from Working in Tech Operations

When I first started working in the operations team of my employer in Mexico (also my first non-finance-related role ever) in 2019, the first thing I learned was setting the objectives and key results (OKR) of the mobility business.

The OKR is broken down into three categories: Growth, Efficiency, and Experience.

What I love about this OKR framework is that it elegantly triangulates the foundation of running businesses of any kind.

“Growth” alludes to size and scalability, usually exemplified by a company’s or project’s gross merchandise value (GMV) or top-line revenue as well as their respective speed of growth.

“Efficiency” means profitability, typically represented by a company’s or project’s operating margin or return-on-investment (ROI).

“Experience” is the quality of the customer’s experience when using the product or service offered. It reflects business sustainability.

Going back to the business interview question, a start-up company would likely pursue Project A because scaling up the business (i.e. proving business effectiveness) matters more than generating earnings in the near-term.

Conversely, a well-established corporation would likely pursue Project B because the business has already gained a meaningful market share and bargaining power where expanding profitability (i.e. proving business efficiency) would take priority.

The game of business is all about scale and profitability, followed by sustainability.

Reaching Operational Excellence in Business

Operational excellence is about developing a solution that can achieve both optimal effectiveness and efficiency at the same time.

Of course! Who doesn’t want “big money”? Easier said than done.

The fundamental hurdle is resource scarcity, which prohibits you from building both a sizable and profitable business easily.

The path to reaching operational excellence therefore needs to be paved by winning the game of prioritization, weighing trade-offs and striking the right balance between being effective and being efficient in every situation.

As challenging as it may sound, there are a handful of deft companies that manage to achieve that level of operational significance.

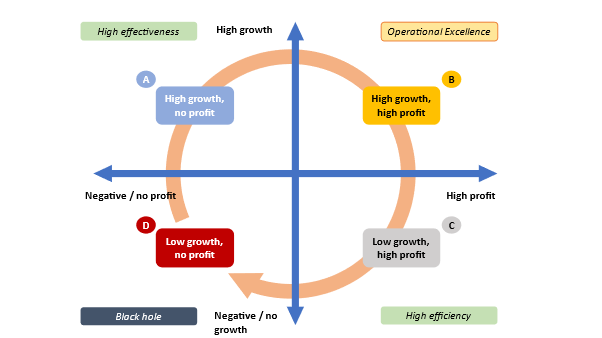

This brings us to the following “Growth-to-Profitability” chart, where virtually every business falls into one of the four quadrants:

As you can imagine, most start-ups would fall in Zone A, where they exhibit hypergrowth in revenue/GMV/market share, but have negative earnings. Many prominent start-ups are effective in scaling up within their specific industries, but not necessarily efficient as their hypergrowth is usually fueled by excessive cash burn.

Think Tesla, Uber, Grab (which, at the time of this post, just announced its IPO plan via SPAC. Here is a detailed investor presentation), JD.com and Kuaishou.

Mature companies, such as multinational corporations (MNCs), conglomerates and leading institutions in traditional industries, are likely to fall in Zone C, where they have been around for decades making profits consistently, but are facing some challenges in expanding their businesses further. In other words, these corporate juggernauts are highly business efficient, but no longer as effective and are susceptible to disruption by emerging competitors.

Think General Electric, ExxonMobil, JPMorgan, Berkshire Hathaway, Volkswagen and BMW.

Zone B is the business “Nirvana”, where every company would like to be at for as long as possible. Organizations in this category demonstrate high-growth in sales and market share and at the same time, achieve profits with expanding margins. They are operating effectively and efficiently.

Some prime examples are Apple, Amazon, Google, Facebook, Tencent, Alibaba, Netflix and Nvidia.

Needless to say, you should probably be looking for a new job if you work at a company that falls in the black hole of Zone D for a continuous period.

Most companies are expected to go through their life cycle in sequence from Zone A to D, even though many are stuck in Zone A, C or D, when Zone B is where every business would prefer to be “stuck” at.

However, Zone B is not the ultimate answer to everything. Companies in Zone A, C and D exist as they serve various other purposes.

Hyper-growing but loss-making start-ups are there to challenge the status-quo by aggressively innovating better products and solutions that the industry incumbents are unable to deliver. Sure, they burn investors’ money, but the lessons learned and knowledge acquired during the founders’ and their employees’ entrepreneurial journey is invaluable.

Well-established, profitable institutions are there to offer consistently high-quality and reliable products and services to customers. They generate steady if not high income to their shareholders and provide a relatively stable work environment to their employees.

Companies that have difficulty both in growing sales and/or making money are model counterexamples. Whether the reason is the wrong business model, weak product-market fit, engineering challenges, cost management issues, leadership or internal politics, these failures serve as red flags for your own company.

If you are an employee, it is worth thinking about where your current employer stands in this chart and whether its stage is well-aligned with your short-term and long-term career aspiration.

If you are a stock investor, it is worth thinking about where the stocks you own fall in the chart and whether the aggregation of those (i.e. your stock portfolio) fit your risk-and-reward investment appetite.

If you are an entrepreneur or business owner, it is worth thinking about where your current company falls within the chart and whether you desire to take it to a different zone.

Attaining Your Personal Operational Greatness

We should not just consider operational excellence in the context of business, but also in the context of ourselves as individuals.

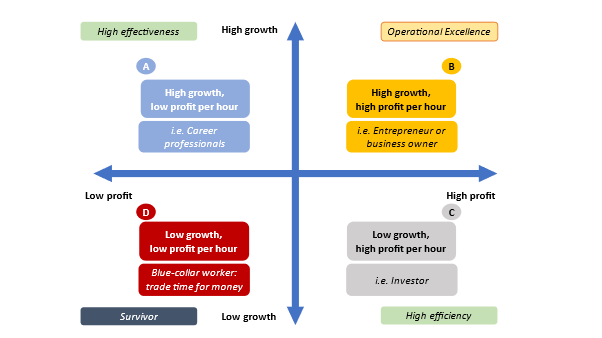

The similar logic shown in my “Growth-to-Profitability” chart can be modified slightly and applied to our personal careers.

Here, I would define effectiveness and growth as your impact towards a business or society.

Zone A: white-collar professionals who earn a salary from their employers

Zone B: those who start their own companies or take significant ownership of a business

Zone C: those who allocate their capital to various asset classes

Zone D: jobs that compensate you on an hourly wage, with no company benefits

There are three major differences about this “personal” Growth-to-Profitability chart versus the “corporate” one:

First, unlike a company, you as an individual can be in multiple quadrants at the same time.

As an example, you can be a manager at an advertising firm doing digital marketing, while running your own e-commerce business on the side, being a weekend Uber driver and part-time math tutor for high school kids, and making personal investments in stocks and real estate.

(Well it might be quite hectic, but that combination is possible, and some people may enjoy that!)

Second, regardless of what your parents or schools teach you, there is actually no set expectation on the sequence of how you should run your career life cycle.

You can jump from being a factory worker (Zone D) to being a restaurant owner (Zone B), to go from investment banking (Zone A) to full-time day-trading (Zone C).

Third, the “operational excellence” quadrant of this chart does not necessarily mean the most optimal.

At the end of the day, achieving personal operational greatness is about finding your own unique performance stage that allows you to unlock your maximum potential and do terrific work, and the stage can be anywhere.

However, if you were to ask for my opinion, here it is:

- Aim to start, but not end, your career at Zone A (career professionals)

Being a career professional and working for someone else helps you build the foundational knowledge and experience in business. It provides you with a structure for upward mobility, a good-enough income, and a platform to build your professional network. It helps you understand how the bulk of our corporate world operates because most people around us are in this zone. It is a good start for one’s career and a low-risk way to earn an income, but not the most efficient way. - Make the leap to Zone B (owner), whenever you are ready

Everyone should try to run their own business at some point in their lives, whether it is a visionary, world-changing start-up or a small online shop selling jewelry.

Although it demands utmost diligence and tests your perseverance, being an entrepreneur gives you an entirely different learning experience and perspective. It is an opportunity to make a bigger impact through leading people while leveraging capital and technology. Ultimately, “taking ownership” is an indispensable step towards self-actualization and financial freedom. - Zone C (investor) should always be part of your life

As soon as you receive your first paycheck in your career, you should begin a lifelong-commitment to investing. I understood this concept when I received my undergraduate degree in business, but regrettably, I did not take action right when I entered the workforce.

Study investment opportunities on a regular basis and always put your cash in use as early as you can. The idea of putting your extra savings to mutual funds, stocks, bonds, real estate or even cryptocurrencies may not make much of a difference to the world, but it is certainly the most efficient way of amplifying your net worth. You will not regret this discipline five, ten, twenty years from now. - Avoid Zone D (survivor) if your situation allows

Time is your most valuable asset. Zone D provides limited job protection or stability, nor does it provide ownership, upward mobility or good-enough financial return. Use your time to trade for money only when you need the immediate cash to survive. Find your way to transition to Zone A, B or C as soon as plausible.

Final Thoughts

I wish the world were as simple as it appears in the eyes of Elon Musk, who could simply crown and retitle himself as “Technoking of Tesla” at one of world’s hottest tech companies.

(By the way, that was a very effective and efficient zero-cost approach in promoting Tesla and himself.)

Unfortunately, our world is sometimes more complicated than just thinking about being effective and efficient.

Consider the distinct approaches that the US and China took in handling the Covid-19 calamity in 2020-2021.

If we only focus on the pandemic, China contained the virus and managed the crisis in a remarkably effective and efficient manner, whereas the US is disappointingly on the opposite side of the spectrum.

But if we look at the situation through a different lens, China’s operating effectiveness and efficiency in handling the pandemic does come with a price that the Americans are not prepared to pay for: the ideology of human rights and freedom.

Luckily, measuring your individual success is a much simpler task than tallying a geopolitical situation.

Regardless of your situation, it is never too late to plan and engineer a pathway towards an effective and efficient career. Technology helps.

If you are young, focus on growth first, while constantly thinking about how to become more efficient over time by starting a business, building systems, and investing regularly.

As you become older, prioritize efficiency, while keep thinking of ways to grow your impact steadily. Your resource (i.e. time and energy) is increasingly more scarce and therefore more valuable to you.

We are our own operations managers. Let’s be brilliant at it.

Sherman

Time to Mobilize.